south carolina state tax customer service

Bring the following items with you. The official South Carolina business web portal provides information to new and existing business owners about South Carolinas requirements for taxes permits licenses and.

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

And contact customer service representatives.

. Call 800-768-5858 to set up your access to the State Disbursement Units interactive voice response system IVR using your Member ID. A current government-issued photo ID. Your Member ID is provided on correspondence.

View All Online Services. Schedule your appointment ahead of time. Manage multiple tax accounts from one login.

And Wednesday from 930 am. Get to kno w. Normal phone hours are Monday Tuesday Thursday and Friday from 830 am.

License plate decals may be delayed for some customers. Open a college savings account apply to teach in South Carolina or browse state job openings. Sales tax is imposed on the sale of goods and certain services in South Carolina.

Popular in Education and Employment. Are drop shipments subject to sales tax in South Carolina. The statewide sales and use tax rate is six percent 6.

The official South Carolina business web portal provides information to new and existing business owners about South Carolinas requirements for taxes permits licenses and. The South Carolina State Park Service hopes you will remember your state parks at tax time. Department of Juvenile Justice.

You can check the status of your South Carolina State income tax refund online at the South Carolina Department of Revenue website. EPay allows taxpayers to submit tax payments by EFW or credit card. South Carolina State Tax Refund Status.

Prepare for Your Appointment. SCDOR provides South Carolina t axpayers with a free and s ecure t ax portal known as MyDORWAY. GSA SmartPay Program Support.

Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which. South Carolina Department of Revenue. The service is safe secure and FREE.

These are the supported South Carolina state tax forms on FreeTaxUSA. South Carolina State Supported Forms. We are closed on weekends and state holidays.

SC 1040 - Individual Income Tax Return. File Pay Apply for a Business Tax Account Upload W2s Get more information on the notice I received Get more information on the appeals process Check my Business Income Tax refund. You have the right to apply for assistance from the South Carolina Department of Revenue SCDOR.

Counties may impose an additional one percent 1. Due to a shortage of the type of paper used for vehicle registrations South Carolinians who have paid their property taxes to the. Schedule NR - Nonresident Schedule.

South Carolina Individual Income Tax Return. You can do that by designating donations on Schedule I-330 contributions for check-offs in your. SC 1040TC - Credit for Taxes Paid to Another State.

South Carolina S Tax Climate Has Become Inhospitable Due To Inaction But That Could Soon Change

South Carolina Sales Tax Small Business Guide Truic

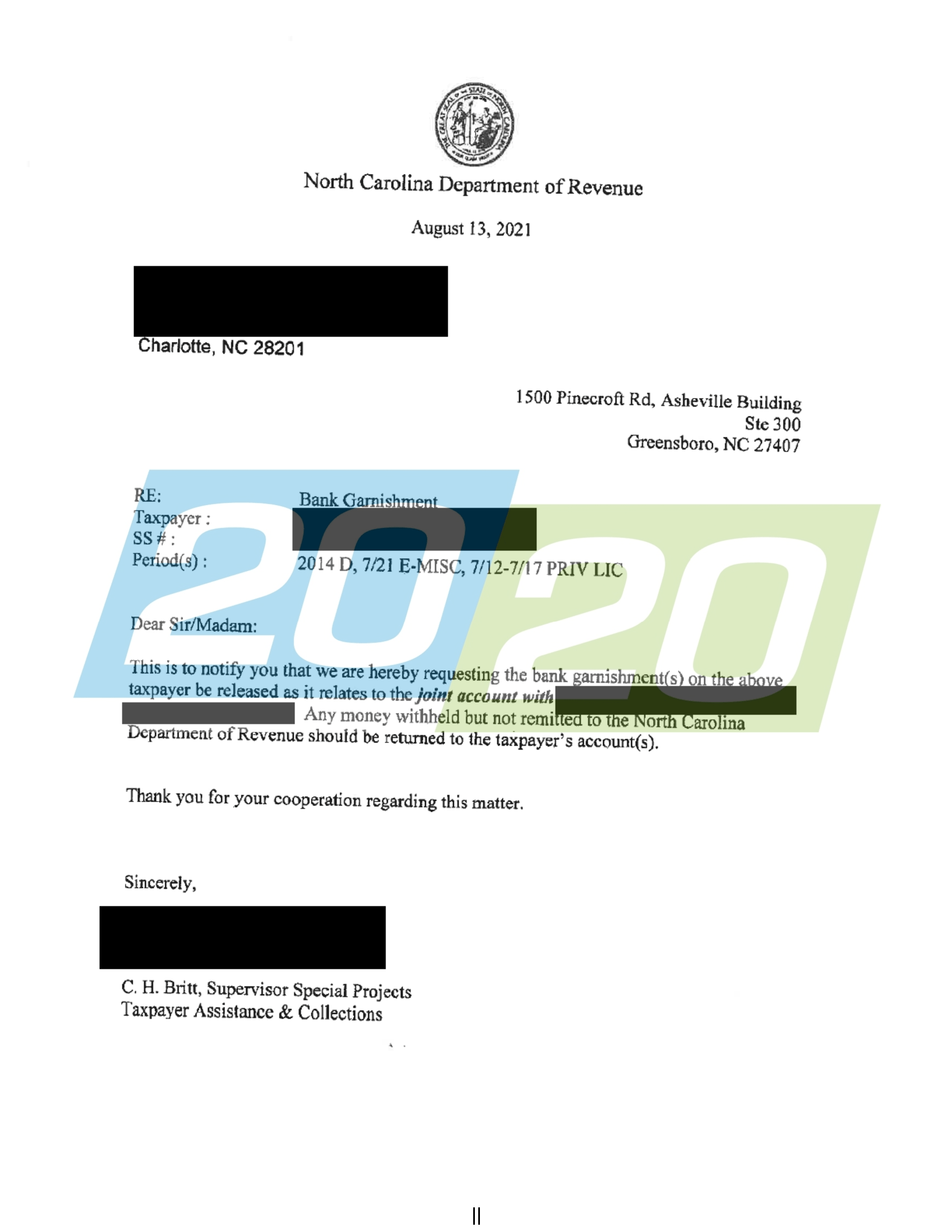

Tax Burdens Lifted In North Carolina 20 20 Tax Resolution

Cfma S 2021 Guide To State Tax Laws South Carolina Cfma Store

North Carolina Sales Tax Rate Rates Calculator Avalara

Information For Parents Receiving Support South Carolina Department Of Social Services

Taxes International Student And Scholar Office Unc Charlotte

Record Sc Spending Plan With 1 Billion Tax Rebate Passes The State

Lawmaker Wants To Cut South Carolina Income Tax In Half Eliminate It For Businesses Wjbf

North Carolina Income Tax Calculator Smartasset

South Carolina Sales Tax Quick Reference Guide Avalara

Here S How Much Money You Could Get From Sc Income Tax Rebate Wltx Com